inheritance tax on real estate nc

Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to.

Sell Your House North Carolina Buying Investment Property Investment Property Home Buying

In fact the IRS does not have an inheritance tax while some states do have one.

. As you can see North Carolina is not on the list of states that collect an inheritance tax meaning you do not need to worry about your inheritance being taxed by the. North Carolina has no inheritance tax or gift tax. Taxable estates ranging from 0 to 10000 are taxed at an 18 rate and on the higher end the.

These include Capital Gains income tax from retirement accounts and other like taxes. Lets look at how estate and inheritance tax in NC works. So if you live in N.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. For 2022 the annual exclusion is 16000. You may pay taxes if you give a significant monetary gift to an heir while still living.

North Carolina Estate Tax. These tax issues vary a great deal based on state law and unique circumstances so if you have a tax. There are 12 different brackets with rates ranging from 18 to 40.

North Carolina is one of 38 states with no estate tax. What is the federal inheritance tax rate for 2021. The inheritance tax is the tax charged to a person that receives an inheritance and it is that person that needs to file a tax return to report what was received.

Estate tax or inheritance tax. Gifts of less than 16000 per year per individual are not taxed. Annual Gift Tax Exclusion.

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. Prior to 2013 the state did have an estate tax but it was repealed in July 2013. The estate tax is a tax on a persons assets after death.

What is the North Carolina estate tax exemption for 2021. If you are planning your estate you can. What is the current inheritance.

In 2021 federal estate tax generally applies to assets over 117. No Inheritance Tax in NC. There is no federal inheritance tax but there is a federal estate tax.

What To Know About Selling A House In An Irrevocable Trust

Real Estate Blog Resources Pdh Real Estate

Real Estate Investing 101 Book By Michele Cagan Official Publisher Page Simon Schuster

North Carolina Estate Tax Everything You Need To Know Smartasset

Sell Your House North Carolina Selling House Sell House Fast Sell Your House Fast

Rent Vs Buy The Definitive Guide Rent Vs Buy Rent Real Estate Tips

Pin On We Buy Houses In Greensboro North Carolina

Mistakes In Deeding Property To Children

Professional Liability For Real Estate Agents

Transferring Property Ownership Pros Cons Other Options

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States

Nova Scotia Real Estate By Hants Realty Ltd Facebook

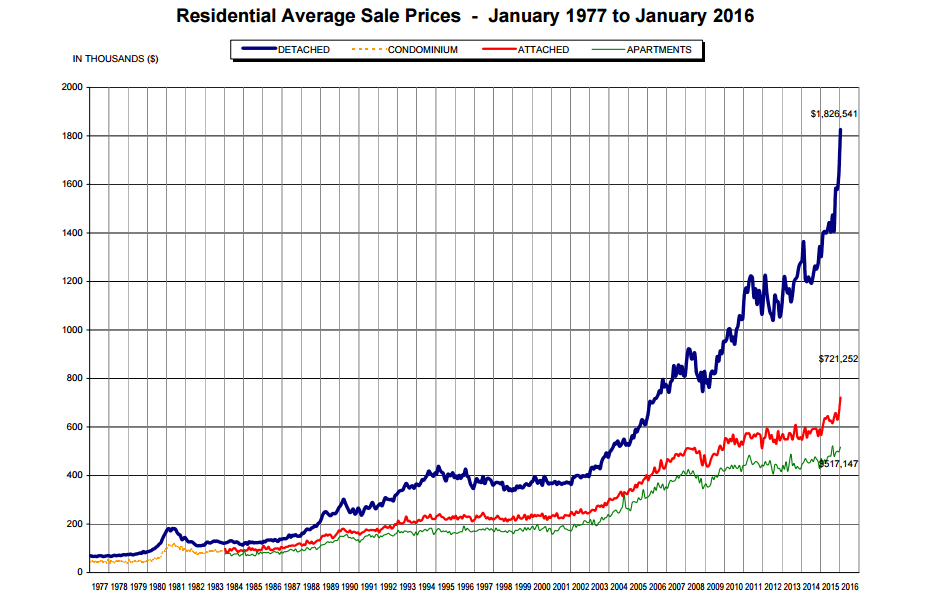

One Chart Shows How Unprecedented Vancouver S Real Estate Situation Is Globalnews Ca

What Is Fee Simple In Real Estate Bankrate

Pin On Real Estate Info Articles And Tips

U S Withholding Tax For Real Estate Sales By Foreigners

Buy Build Or Fix What S Best For First Time Home Buyers Almosthomefl Home Realestate Fthb Swfl Mortgage Rates First Time Home Buyers Mortgage

/GettyImages-1151040853-30a8728deb3b45a9bf73424740886fed.jpg)